Tuesday October 7, 2025 10:31 pm

Tuesday October 7, 2025 10:31 pm

ECONOMYNEXT – Sri Lanka should keep a watch on private credit, which has grown rapidly over the past year, Richard Walker, World Bank Senior Country Economist said.

“There has been a sort of softening of monetary policy,” Walker told reporters in Colombo after releasing a Sri Lanka Development Update.

“But the concern going forward is this has to be continued to be well calibrated to mitigate again some inflationary pressures as well as the sort of unsustainable build-up in private sector credit.

“You’ve seen a very very high and rapid growth in this credit over the last year or so.”

“Financial sector risks need to be carefully monitored. This includes also the elevated levels of non-performing loans which you see as well as this continued high exposure of the banking sector to government.”

Sri Lanka’s private credit grew 906 billion rupees in the seven months to July with 200 billion rupee expansions in the last two months.

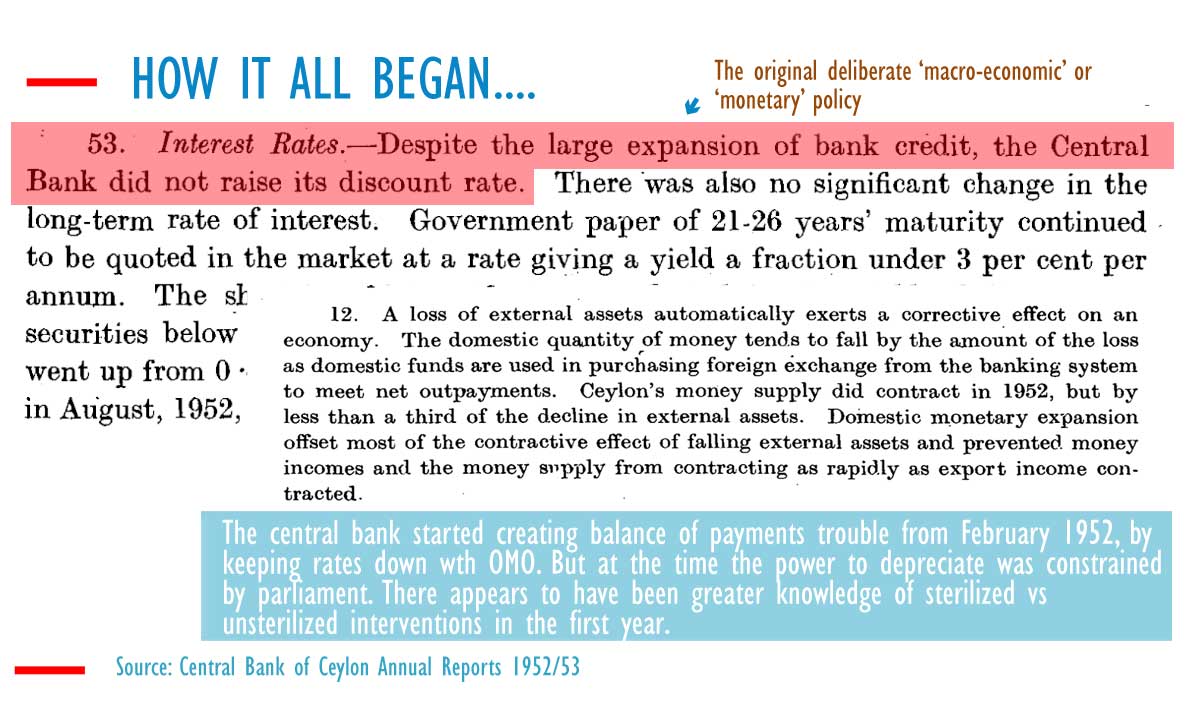

In Sri Lanka, private credit recovers about 18 to 24 months after rate cuts backed by inflationary open market operations trigger a currency crisis and a collapse in domestic demand, analysts who track inflationary policy have pointed out.

Rates have to be hiked to very high levels to kill credit and restore the lost confidence of the notes of the central bank which lead to forex shortages and multiple exchange rate rates.

In the last crisis, private credit contracted in absolute terms, from June 2022 to around May 2023. In 2023 private credit contracted by 123 billion rupees.

Loans – especially those given late to smaller companies which have low equity – then go bad as the currency collapse kills purchasing power reducing sales.

After confidence in the currency is restored by killing private credit, and savings and loan repayments start to build up in the banking system – some of which may be exported as foreign reserves after liquidity is mopped up through deflationary operations – and rates start to fall.

The budget deficit which initially expands from high rates and a contraction in the economy after the currency collapse, then starts to deficits reduce somewhat as taxes are hiked in an ad hoc manner under an IMF program.

After the currency stabilizes, inflation stops, though 12-month inflation may fall slowly due to a statistical effect.

Sri Lanka’s central bank cannot destroy the purchasing power of remittance earning families and they play a part in the subsequent quick recovery from a currency crisis, analysts say. Agricultural product prices also match inflation fast and export workers may get the first salary hike.

As salaries are raised in surviving companies, demand gradually recovers.

In 2024, private credit expanded 789 billion rupees. Performance of energy SOEs improved.

The cycle repeats as rates are cut with inflationary open market operations under ‘flexible inflation targeting’, as credit recovers. Reserve targets in an IMF program are missed.

However, in late 2024, there was a public outcry as inflationary open markets resumed to enforce rate cuts, which critics said will lead to fresh forex shortages, another bout of depreciation and social unrest and a second external default.

Meanwhile the World Bank report said “the central bank discontinued reverse repo auctions,” and excess liquidity moderated compared to January 2025 level and came mostly from dollar purchases.

It is not clear when inflationary operations (reverse repo auctions) will resume, along with forex shortages and depreciation which accompany them.

Analysts have pointed out that aggressive inflationary operations and high levels of excess liquidity from domestic operations represents a jettisoning of a scarce reserve regime vital to collect reserves and repay debt and avoid a second default from forex shortages.

Without inflationary central bank operations, banks and finance companies are forced to fund credit with deposits, curtailing consumption in a scarce reserve regime. If banks cannot raise deposits at current rates or for any other reason, they also have to slow or delay new credit, which keeps the external sector in balance.

However, analysts have pointed out that it is possible to fire asset price bubbles or fund projects without adequate returns and also reduce reserve collections by cutting rates with ‘signalling’ alone, without inflationary open market operations.

Actual forex shortages emerge from inflationary open market operations. At the moment, there are some deflationary operations through government coupon repayments of the central bank’s bond stock. (Colombo/Oct07/2025)

Continue Reading

Leave a Reply