It is very easy to get lost in the day-to-day action of trading.

As headlines arrive by the hundreds, market narratives are often obscured by short-term movements; a small mean-reverting day can seem like the end of the world as we know it, even when the broader picture remains unchanged.

Hence, as a trader, it is always beneficial to review the higher timeframes to confirm the current trends for most assets, spot any potential hurdle or pattern emerging and to identify key levels that may come into play in the upcoming days and weeks.

Today, we will analyze the Weekly charts for the S&P 500, Bitcoin, Oil, Dollar Index and Gold.

S&P 500 Weekly Chart – Overbought RSI but no divergence, parabolic rise

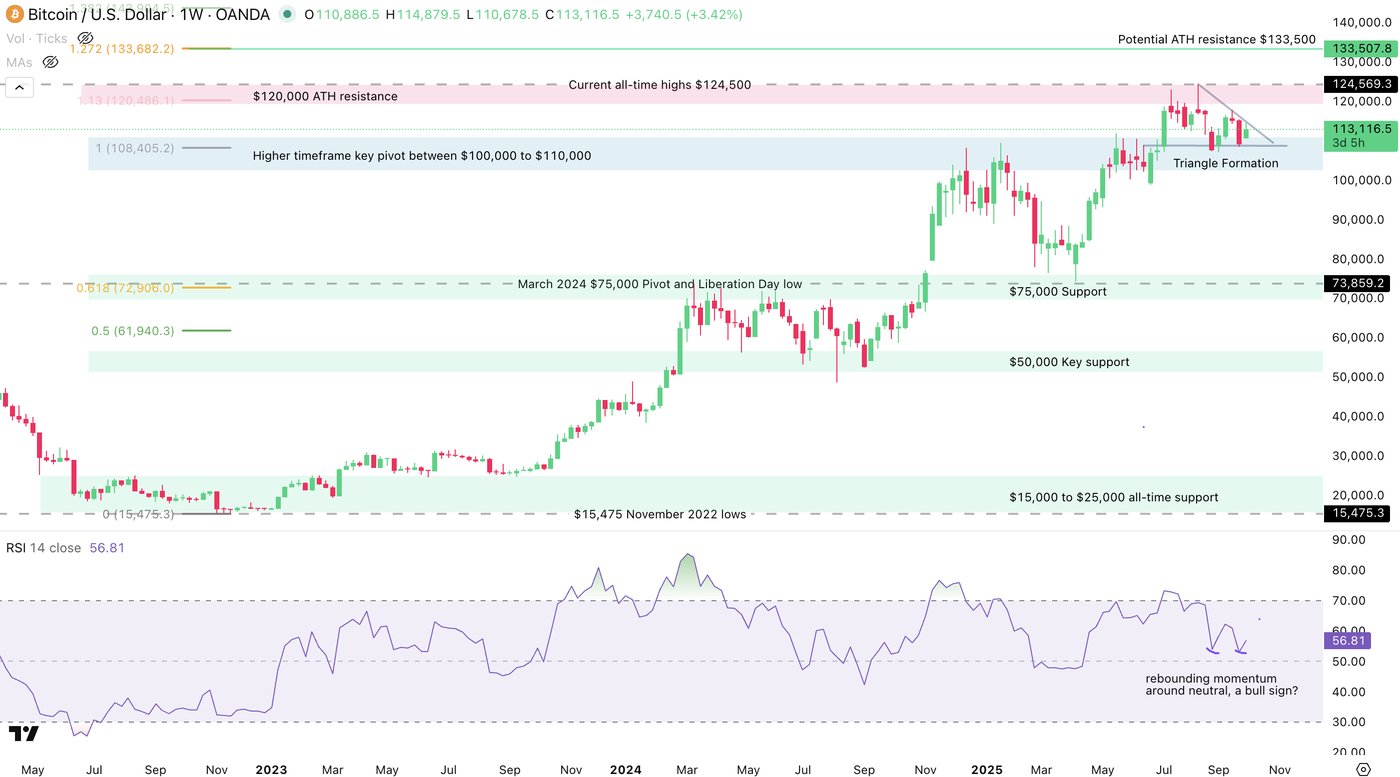

Bitcoin Weekly – Triangle formation at the highs, momentum turning bull

US Oil Weekly – Monthly triangle formation showing indecision, but bear trend not out of sight

Dollar Index Weekly – Consolidation at the 3-year support but below still bearish momentum

Gold Weekly – Parabolic but extremely strong trend, key Fibonacci-extensions ahead?

Safe Trades!

Follow Elior on Twitter/X for Additional Market News, interactions and Insights @EliorManier

Opinions are the authors’; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2025 OANDA Business Information & Services Inc.

Leave a Reply