Saturday November 8, 2025 3:45 pm

Saturday November 8, 2025 3:45 pm

ECONOMYNEXT – Sri Lanka’s plans to remove so-called para-tariffs, and the introduction of a higher 30 percent duty band is not aimed at getting any additional revenue, Treasury Secretary Harshana Suriyapperuma said.

The budget for 2025 said a 30 percent rate will be added to the current import duty bands of 0, 10, 15 and 30 percent.

The intention was to progressively eliminate so-called para tariffs including an import CESS, PAL and SCL which can eliminate competition protection and give a free hand for domestic production lobbies that cannot compete in export markets to exploit customers at home.

Para-tariffs can also fall a found with other bilateral trade partners and the World Trade Organization.

“This particular exercise is to harmonize ourselves with the region, with the global approaches as to how duties are being charged and doing away with the para-tariffs,” Suriyapperuma said in a post-budget seminar with Deloitte and Echelon magazine.

‘Because we want to integrate Sri Lanka to the global markets.”

There was no expectation to get additional revenue from the duty hike, he said.

“We consider it as a revenue neutral, more or less, so it is not targeting, generating of revenue, integrated better with the global economy.”

“That’s where a dedicated committee has been set up through the approval of the Cabinet, where existing trade agreements are to be reviewed to see what are the potential, what are the areas that we have not explored.”

A specific time table to end the exercise has not been set, but implementation is likely to start from the first quarter of 2026, Suriyapperuma said.

However some ground work has to be done first.

In a protected economy, domestic producers outside zones, cannot become export firms and naturally diversify exports, partly because inputs are taxed and partly because under protection, they have no incentive cut costs or improve quality to go into foreign markets.

Sri Lanka however has seen individual and companies start in and IT and software where there is no protection.

The first country that broke an orthodoxy that small countries should import substitute and could not become industrial exporters was was Hong Kong, which had no raw materials, but only had monetary stability, free trade and policy stability (governance) with no interference from state.

Taiwan followed after gaining monetary stability in 1960 and giving tax rebates for inputs to escape import duties and then starting duty free zones after copying a free zone seen in Italy.

Singapore followed next by eliminating all duties in one day, breaking the so-called ‘common market’ with Malaysia based on the import substitution orthodoxy peddled by some UN experts, and setting up a currency board to assure monetary policy.

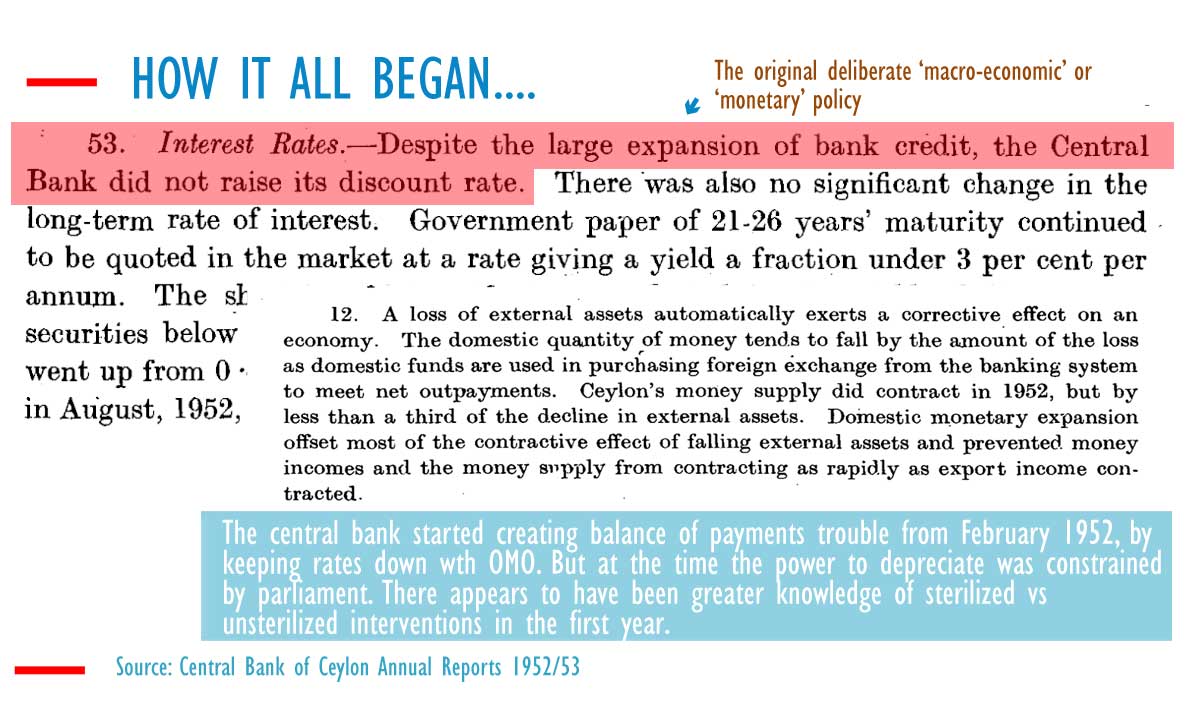

Sri Lanka, once a broadly free trading, country with no balance of payments trouble started to impose ad ho taxes after a balance of payments trouble in 1952/53 and moved into heavy import substitution as monetary instability worsened progressively.

In 1978, most economic freedoms were restored without monetary stability and social unrest persisted.

But from November 2004, new import taxes were slapped Sri Lanka in a 25-page gazette for ‘balance of payments’ which has then exploded into rent seeking oligopolies. The import protection then expanded into food, which critics say contributes to malnutirituo which also expanded into food also.

Sri Lanka also has another para tariff called the special commodity levy on foods, but which is sometimes lower than the CESS+VAT+PAL which is charged on foods which are not under SCL. (Colombo/Nov08/2025)

Continue Reading

Leave a Reply